VR (Virtual Reality) has existed for quite some time. Like air, it has always been with us. However, VR is recently being magnified as an important tool.

In the past, it was difficult for individuals to purchase VR separately for use, because it could only be used at specific places equipped with high-priced devices. However, the personal VR market is receiving a lot of attention these days by the HMD developer Oculus, which burst onto the VR market after being acquired by Facebook for approx. KRW 2 trillion. With high distribution rates of smart phones, 360 Cameras, and expertise of 3D content production, the VR market value has increased even more.

Starting with Oculus, personal VR is now expanding based on the HMD (Head Mounted Display). The HMD is the concept initially developed by Professor Ivan Sutherland at the electrical engineering department of Harvard in 1968. The first developed device was too heavy to be held alone, and had to be attached to the ceiling. Subsequently, it underwent development for helmets used by pilots. In 1995, Nintendo developed the first HMD game for general users, which was called ‘Virtual Boy’. However, the Virtual Boy disappeared due to the heavy weight of 2kg, low sense of immersion, absence of contents, digital motion sickness caused by cognitive dissonance, etc.

Oculus’s recent attention is moving away from the HMD and Virtual Boy developed by Ivan Sutherland. Differing from conventional HMDs, which showed large flat display before the eyes, Oculus widened the viewing angle by using the hybrid fresnel lens while improving a sense of immersion by adopting a method to correct distortion through output calibration. From low weight to head tracking and positional tracking, there are a number of reasons Oculus has distinctively attracted attention from other HMDs.

Current status of VR Hardware

Currently there are two types of VR headsets: PC- or console-based high performance hardware, and those for mobile devices. These include the PC-based Oculus Rift and HTC Hive, console-based Sony PS VR, mobile-based Samsung gear VR, etc.

To run the Oculus Rift, a high performance PC is required. A compatible PC generally costs approx. KRW 1,500,000 – 2,000,000. The PS4 and PS4 cameras needs to be purchased separately for the PS VR, and only the latest smart phones are compatible with Samsung gear VR. A minimum of KRW 1,500,000 to a maximum KRW 3,000,000 is what it might cost in order to enjoy VR using equipment with external devices including a VR headset. The price will increase if purchasing the Virtuix Omni, KATVR, etc. in order to enjoy the game contents with higher sense of immersion. It is still unaffordable for the public.

However, the VR headset using a mobile device is financially more affordable. In addition, the mobile device-based VR has advantages of low expense and less spatial limit compared to PC- and console-based VR. However, a crucial issue is image quality. 2K display is not enough for VR; therefore, 4k display is required in order to fully enjoy VR. Currently 2k display comes in most smart phones, while Sony launched the Xperia Z5 Premium with a 4k display last year, the first in the world. Although generalization of mobile phones equipped with 4k display is expected, several problems might occur with 4k display.

First of all, battery will run down too fast due to use of high electric power. Even if battery levels are increased to solve this problem, the size of mobile devices will be enlarged. In addition, it will cause heating issues on the device while supporting high resolution. It might be improved gradually; however, clear alternatives are not available at this time. The heating problem occurred in Samsung gear VR in the past can be understood in the same context. As long as the two types of issues mentioned above are not solved, the range of content genres available for current mobile-based VR will remain limited to a certain degree.

Current status of VR content

Currently various genres of VR content are on the market, such as game, movie, animation, 360 degree images, relaying, vocational training, 4D content, etc. For example, there are approx. 250 contents in the representative platform, Google Play Store, 2,000 contents on Oculus Share, and 300 contents on the Steam VR Store. In addition, 360-degree content is available on Facebook, YouTube, etc. The scale of content platforms is still small and outstanding contents are not yet found around the globe.

Previously, ‘killer content’ such as Final Fantasy by Play Station, Anipang by Kakao Game, etc. took the lead in terms of device and content distribution platforms. Currently, Oculus, Qualcomm, Android, etc. support content developers to develop high-level contents with high sense of immersion, by providing their own SDK. Based on this, they are trying to obtain ‘killer content’ to establish a market-leading VR contents platform.

There is no VR content platform available for various genres of content in South Korea, even though Naver, Gom Player, Africa TV provide 360-degree content. Current VR content tends to focus on 360-degree image as there is no platform organized yet. The question brought up at this point is ‘how many people will purchase high-priced PC-based VR headsets in order to enjoy 360 degree images?’ As known from current status of domestic platforms, the possibility for domestic consumers to experience VR as 360 degree images via smart phone-based Samsung gear VR or lower-priced Google Cardboard is very high.

In addition, the mobile-based VR headset is not enough to contain various genres of content yet due to its hardware limit. Currently only the 2k display-based smart phones are on the market. Even if 4k display-based smart phones are launched, the limit of content genres available for mobile-based VR will remain due to battery durability as well as heating problems. That is why domestic VR content market needs to focus on 360 degree images or other image content, rather than other on genre content, which are free from battery and heating problems. By accumulating consistent user experiences in image content, justifiability to consume VR contents needs to be suggested to domestic consumers.

Current status of VR Market

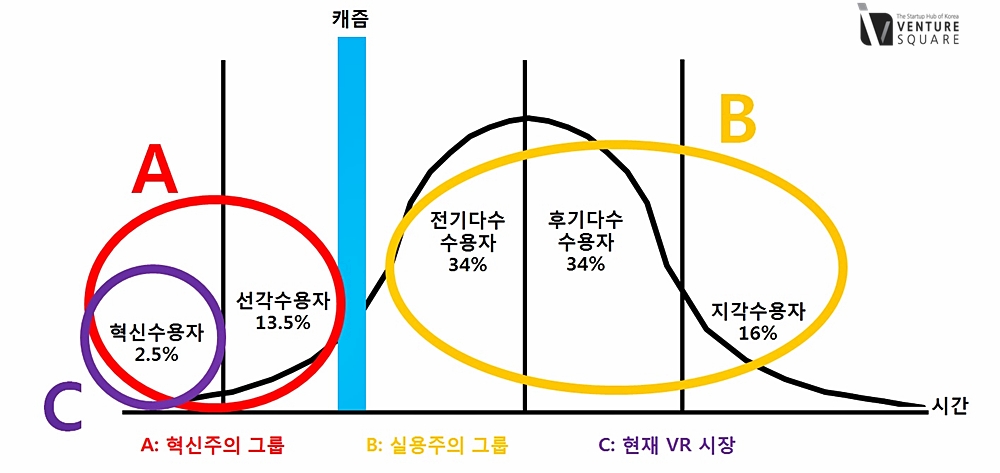

According to Chasm Theory by Moore, the initial market is created by innovative consumers with foresight (A) who accept novel products with no hesitation, while initial, late and other majority of consumers (B) who put stress on practical aspects need to be persuaded for breaking into larger markets. A blank is made at this stage, which is called Chasm (sky-blue).

In order to advance from innovative consumers with foresight (A) to majority of consumers (B) beyond the Chasm, accessibility should be improved by lowering the hardware costs, or justifiability should be obtained by creating content of quality. Chasm (sky-blue) can be resolved by accumulating user experiences, which are still lacking, with emergence of VR hardware with higher performance at lower cost compared to previous VR hardware, production of killer content, etc.

The VR market will be clearly classified at an intersection point of accessibility (cost) and justifiability, leading to creation of a complete market. This is because one hardware and platform will be collected and standardized during the process of market expansion from innovative consumers with foresight (A) to majority of consumers (B) for overcoming Chasm.

If you don’t understand the Chasm Theory, think of smart phones, 3D TVs and 3D printers. Smart phones can be seen as a case of overcoming Chasm, 3D TVs as a failure case and 3D printers as being located in somewhere on the edge of Chasm.

The global VR market is valued at approx. KRW 8 trillion in 2017 and is expected to reach approx. KRW 81 trillion in 2020. Domestically, it is expected to grow from approx. KRW 1.3 trillion in 2017 to KRW 5.5 trillion in 2020.

One noticeable fact is that majority of experts expect the VR content market to grow into a market three times as large as the VR hardware market. As mentioned earlier, it will matter whether or not the ‘killer contents’ are obtained in the future VR market.

Several problems such as quality of image, battery, cost, lack of user experience, etc. were suggested above. The problems with quality of image, battery and cost will be solved with hardware development, while lack of user experience should be solved with killer content development. How should the startups planning to develop killer content deal with current status?

They can deal with current status in terms of a content matrix using PC and console high performance hardware-based VR headsets or mobile-based VR headsets.

First of all, as mentioned above in the statement on the current status of VR content, domestic consumers are likely to consume content such as movies or 360-degree performance images with mobile-based VR headsets. Since 4k display-equipped mobile devices will become generalized in the mass market soon, the startups preparing image content need to prepare for this generalization of 4k mobile devices. If the hardware problems are solved in this way, what do the startups creating VR image content need to adjust to? They need to increase the time spent on enjoying image contents. According to current relevant industry officials, consumers spend an average of 3-5 minutes using content. It is because most image contents do not require consumers to use the VR headset. Therefore, to watch images justifiability through well-structured story-telling must be a priority. In addition, the fixed viewpoint to minimize digital sickness can cause dizziness, while removing camera motion can cause digital sickness. Therefore, more research on solutions to resolve these phenomena is required in all processes from shooting to editing.

Lastly, PC- and high performance hardware-based VR headsets are highly likely to consume game content as they are the optimized devices for game content. The Oculus Rift started sales last month, but domestic distribution is not sufficient yet and the VR markets worldwide are still small. In addition, a lot of resources are needed for creating VR game contents. That is why most corporations entering into the VR industry are giant-sized companies. Nevertheless, the startups need to break into the global markets. This is because the global markets provide more chances of winning compared to the domestic market, which are not yet well-established. Rather than immoderately putting an effort to preoccupy the market, the startups need to enhance their strengths and consider collaboration with other startups to maximize the synergy effect.

The current status of the global VR market is in a turbulent period. There is no platform or hardware defined as ‘right’. From the content production companies’ viewpoint, there is no definitive answer to the question of which contents should be provided to whom, or to which hardware, or to which platform. However, one platform will be gradually converged and standardized, by overcoming Chasm and as passing from innovative consumers with foresight (A) to the next stage. In addition, it will become clear which market is to be targeted. Waiting for the time when the target market becomes clarified and establishing a strategy accordingly, rather than breaking into the current VR industry by going with a flow, could be one way. Despite the advantage of initially breaking into the market, the question ‘Why now?’ is more important. It should be determined after careful consideration of whether or not consumers can be captured by one’s own key competency and when the best time would be to break into the market.

As a number of experts insist, the VR market will rapidly grow, starting with this year. It is the time for individuals or corporations, industrial experts and governments to discuss sensible solutions together.

You must be logged in to post a comment.